A September Rate Cut Is Coming, Whether Powell Wants To Or Not

- Carnivore Aaron Trades

- Aug 1, 2025

- 2 min read

After the market's response to today's Nonfarm payroll report, a September rate cut is coming, regardless of what Powell thinks of Trump. Today the Nasdaq 100 (NDX)(QQQ) tumbled for a sizeable 2% loss on the session as bond prices surged with the 2 year yield dropping an astounding 27bps (-6.94%) which now leaves the Federal Reserve and Jerome Powell no excuse to pass on cuts with the 2 year now being a full 100 basis points below the effective fed funds rate (EFFR).

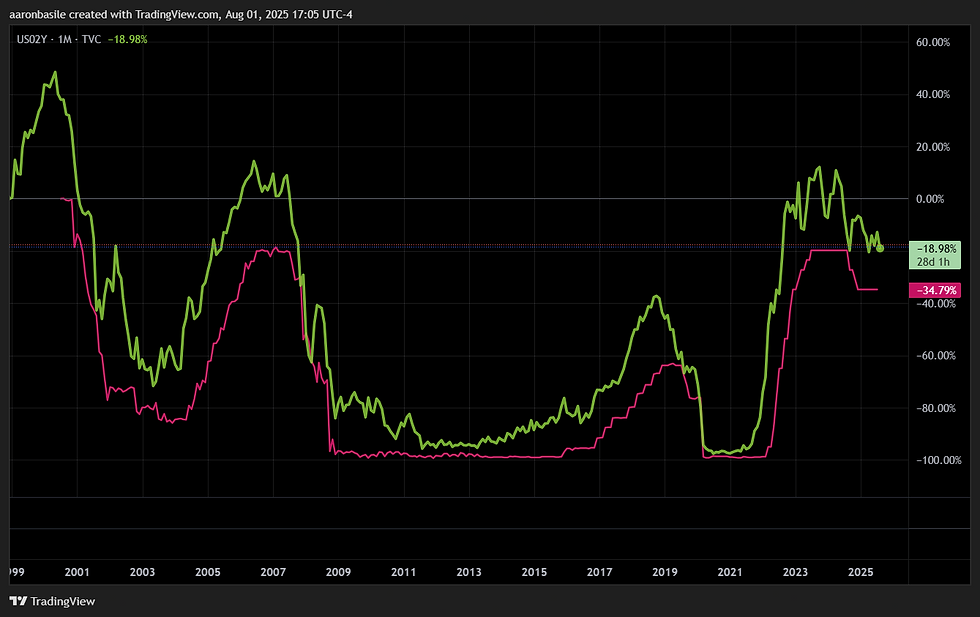

Zoomed out:

Much ado is made over whether Powell will or won't cut due to politics and/or other "agendas" but the truth of the matter is that the Federal Reserve itself does not set interest rates like most people believe.

The going Fed funds rate (often just referred to as "interest rates") are set by the 2 year Treasury note yield. The Federal Reserve simply follows this yield when determining their interest rate policy. This has essentially always been the way despite what politicians and pundits often allude to.

As you can see above the Fed funds rate (pink) follows the 2 year yield (green) as the Federal Reserve simply does their best to track this asset, sometimes lagging, as we saw in 2021-2022. With the behavior in the stock market today, the current fear may be that the Fed will be too late to cut much like they were in years past like '06 - '08.

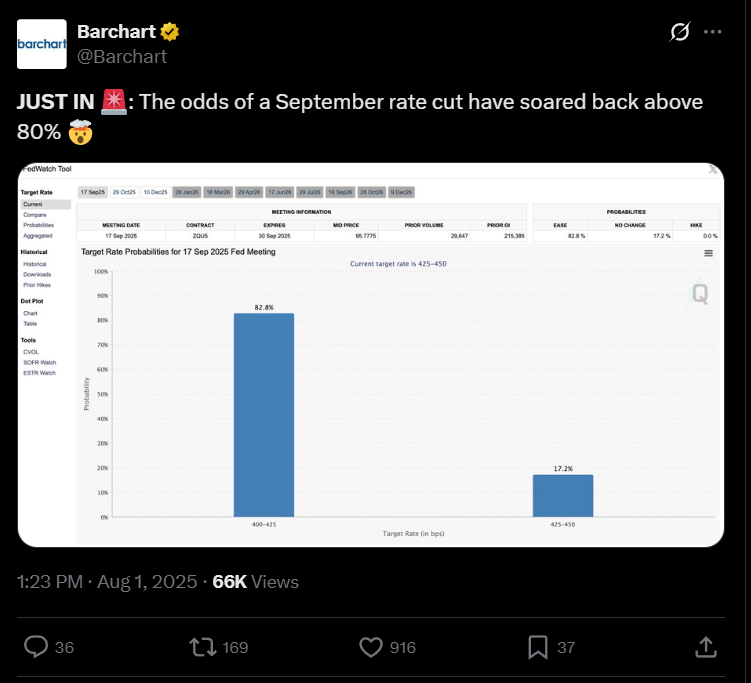

The market agrees with this thesis - As of today's massively disappointing jobs number, traders have begun to price in rate cuts in September, as well as addition cuts by the end of the year which is something that had been been put on the shelf prior to today's data.

To be fair - Fed Funds futures are typically very reactive and are not always accurate outside of the weeks leading up to each Fed meeting so there is nothing set in stone at this point.

With that being said, the technical damage shown in the first two charts above suggests they may be correct, and should at the very least be respected unless something changes.

In addition, the fact that stocks reacted so negatively today to rate cut odds rising is a warning sign that volatility is likely here to stay. After all it's rate cuts that the market has been longing for this whole time. The fact that they aren't reacting positively on this revelation is a major red flag and could signal that something else may be afoot. 🔐For access to premium trading content including swing trade alerts & live day trading room visit 👉 - https://www.carnivoretrades.com/

🎥 Youtube - @carnivoretrades

🐦X - @aaronbasile

📷Instagram - @carnivoretrades

✍️Substack - @carnivoretrades

Comments